capital gains tax increase date

April 23 2021. The proposed effective date is for taxable years beginning after december 31 2021.

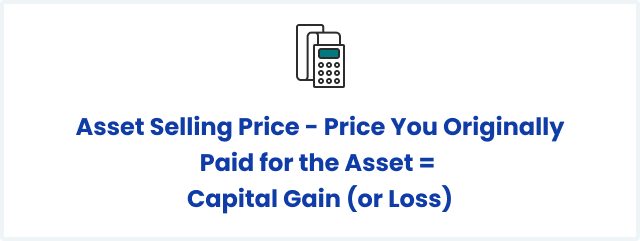

Capital Gains Tax What Is It When Do You Pay It

Retroactive to september 13 2021 date proposal was released capital.

. Weve grouped them here by some key dates. The effective date for this increase would be september 13 2021. President Biden will propose a capital gains tax increase for households making more than 1 million per year.

This resulted in a 60. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large. If adopted this proposal would likely be.

Ad Wealth Enhancement Group Provides Comprehensive Financial Guidance Nationwide. Capital gains tax is likely to rise to near 28 rather than 396 as Joe Biden plans Goldman said. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and.

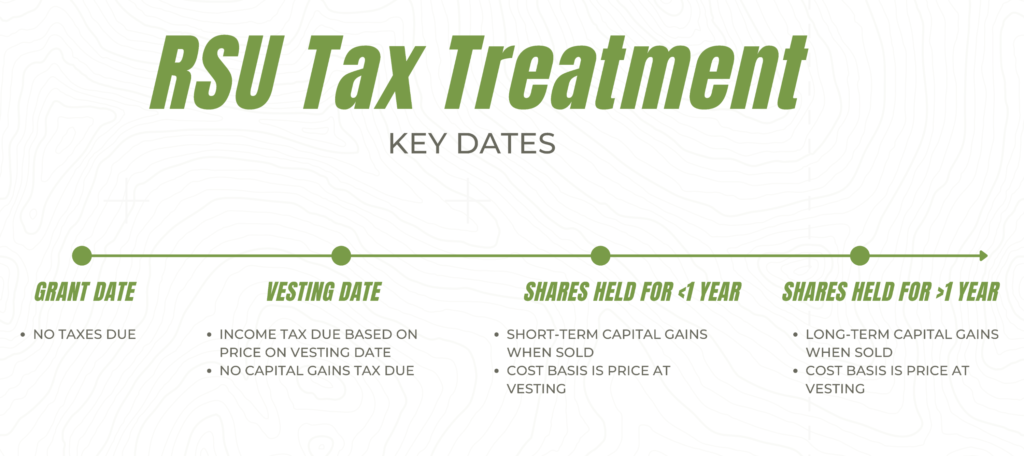

Hawaiis capital gains tax rate is 725. A Guide to Understand Your Options With RSUs Deferred Comp Plans More. Above that income level the rate jumps to 20 percent.

The rates do not stop there. That applies to both long- and short-term capital gains. Understanding Capital Gains and the Biden Tax Plan.

Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. Those tax rates for. If you sell small-business stocks or collectibles the maximum capital gains tax rate is 28.

There is currently a bill that if passed would increase the capital gains tax in. In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. In 2022 individual filers wont pay any capital gains tax if their total taxable income is 41675 or less. Unlike the long-term capital gains tax rate there is no 0.

Ad Wealth Enhancement Group Provides Comprehensive Financial Guidance Nationwide. Additionally a section 1250 gain the portion of a gain. The House proposes that its capital gains increase apply to sales on or after Sept.

Long-Term Capital Gains Taxes. A Guide to Understand Your Options With RSUs Deferred Comp Plans More. Capital gains tax rates on most assets held for a year or less.

In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or 20 rate. For single tax filers you can benefit.

Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status. The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987. 4 rows The proposal would increase the maximum stated capital gain rate from 20 to 25.

Could an increase in the capital gains tax be a tax revenue detractor. The top rate would jump to 396 from 20. 13 2021 unless pursuant to a written binding contract effective on or before Sept.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income.

The bank said razor-thin majorities in the House and Senate would make a big. 2 assumes annualized growth of 1155 and a 25 capital gains rate Source.

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

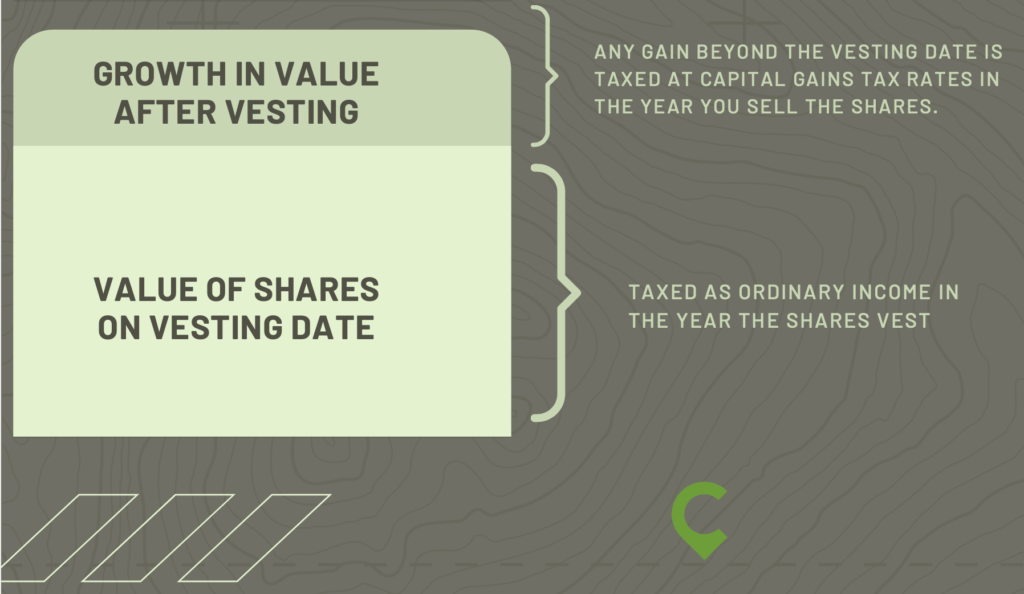

Rsu Taxes Explained 4 Tax Strategies For 2022

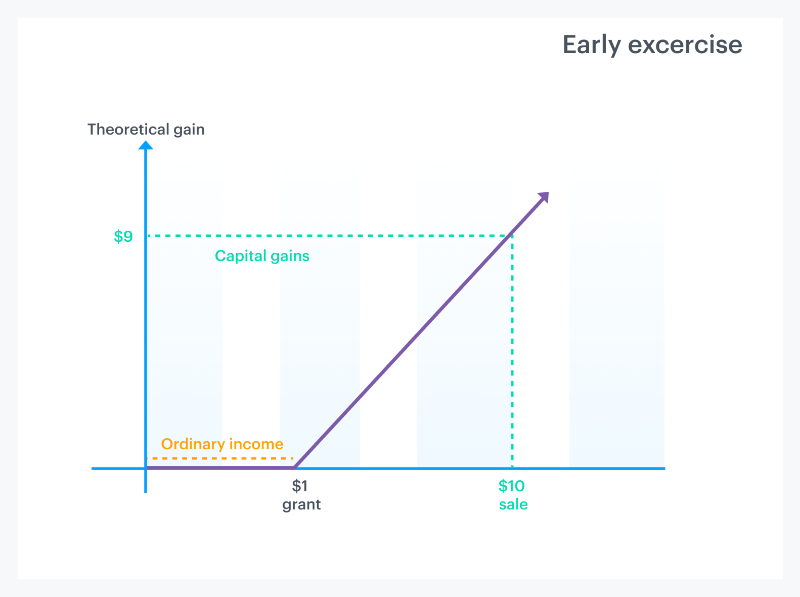

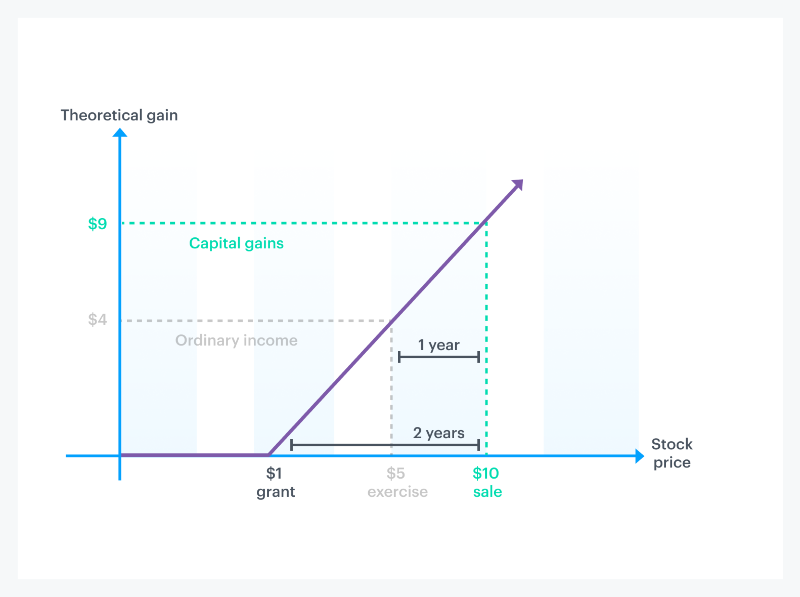

How Stock Options Are Taxed Carta

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Capital Gains Tax What Is It When Do You Pay It

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

How To Save Capital Gain Tax On Sale Of Residential Property

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

Rsu Taxes Explained 4 Tax Strategies For 2022

How Much Is Capital Gains Tax On Real Estate Plus How To Avoid It

How To Calculate Capital Gains Tax H R Block

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

How Stock Options Are Taxed Carta

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)